The world changes drastically due to the limitless capability of technology. This has a broad impact, especially from the entrance of fintech, which has started to disrupt the financial industry. The pressure yields opportunities for small & fast fish, for “fintech startups,” with potential adversely impacts on the incumbents, like commercial banks which have to adapt in accordance to the changes. According to Mr. Michael Araneta, Associate Vice-President for IDC Financial Insights, as stated in Fintech Dynamics in Asia, the Financial Industry includes not only the incumbents, banking and financial institutions, but also fintech startups and other players e.g. non-bank institutions, retail businesses, airlines etc. Those have 4 technology drivers consisting of

- Artificial Intelligence (AI)

- Machine Learning (ML)

- Data Science and Advanced Analytics

- Cloud Services

The top three areas are categorized under a broad definition of “data analytics” to be applied to help organizations reduce labor costs associated with analyzing data manually. These technologies will also be able to further develop the product with a great alignment to customers’ needs. In order to put Artificial Intelligence and Machine Learning into practice, fintechs believe that they must acquire transactional data (as extensive and real-time as possible) and they would also require a reliable platform to interface, collect, and store all this data. This is the reason why the fourth key priority of reliable cloud platforms and cloud services makes sense.

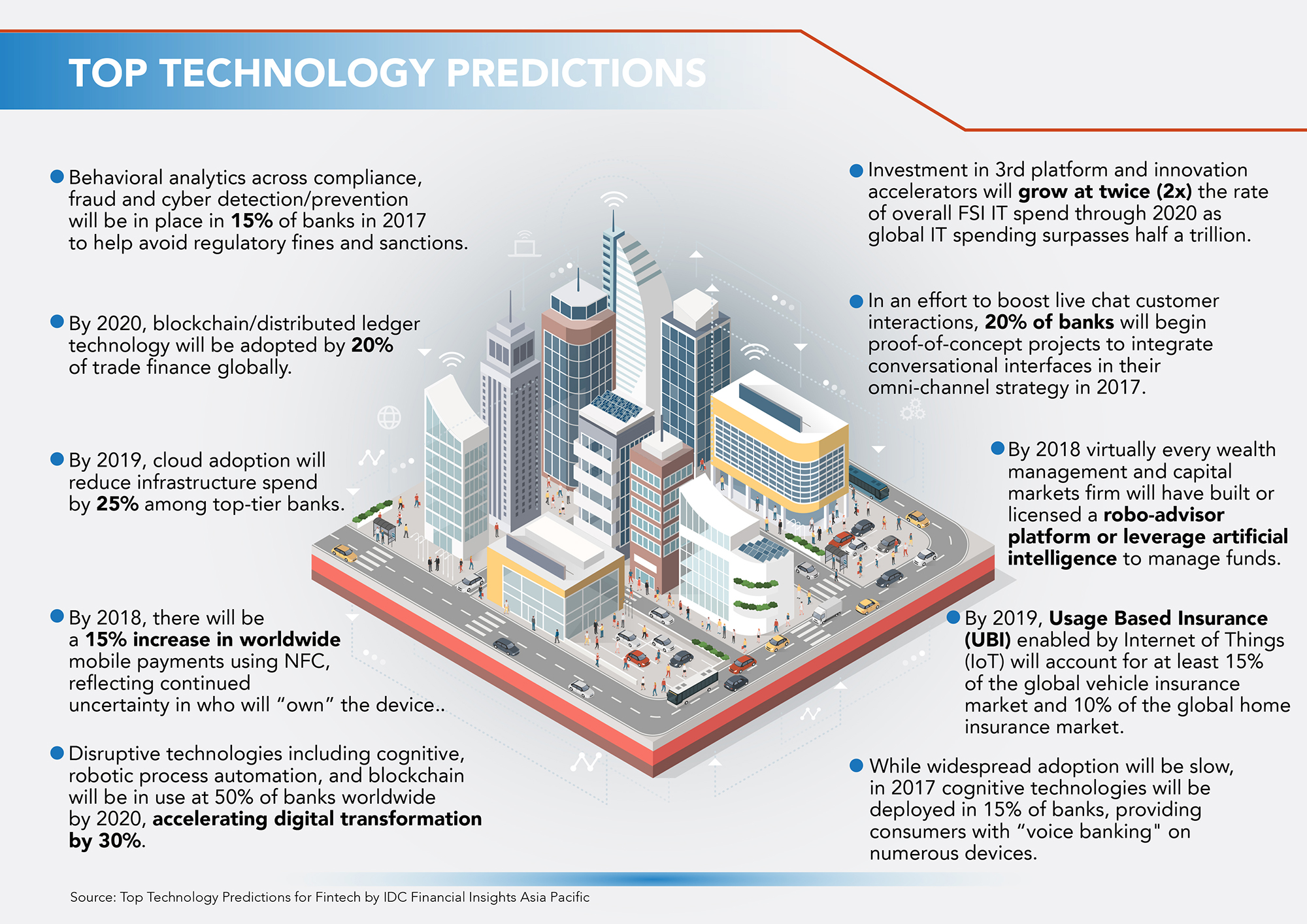

Top Technology Predictions

- Behavioral analytics across compliance, fraud and cyber detection/prevention will be in place in 15% of banks in 2017 to help avoid regulatory fines and sanctions.

- By 2020, blockchain/distributed ledger technology will be adopted by 20% of trade finance globally.

- By 2019, cloud adoption will reduce infrastructure spend by 25% among top-tier banks.

- By 2018, there will be a 15% increase in worldwide mobile payments using Near Field Communication (NFC), reflecting continued uncertainty in who will “own” the device.

- Disruptive technologies including cognitive, robotic process automation, and blockchain will be in use at 50% of banks worldwide by 2020, accelerating digital transformation by 30%.

- Investment in 3rd platform and innovation accelerators will grow at twice the rate of overall FSI IT spend through 2020 as global IT spending surpasses half a trillion.

- In an effort to boost live chat customer interactions, 20% of banks will begin proof-of-concept projects to integrate conversational interfaces in their omni-channel strategy in 2017.

- By 2018 virtually every wealth management and capital markets firm will have built or licensed a robo-advisor platform or leverage artificial intelligence to manage funds.

- By 2019, Usage Based Insurance (UBI) enabled by Internet of Things (IoT) will account for at least 15% of the global vehicle insurance market and 10% of the global home insurance market.

- While widespread adoption will be slow, in 2017 cognitive technologies will be deployed in 15% of banks, providing consumers with “voice banking” on numerous devices.

Sources: IDC-Fintech Dynamics in Asia